For billions of people around the globe, the Bible is the ultimate authority on how to live a moral, faithful, and meaningful life. From the pulpit each week, we hear its lessons on love, forgiveness, and salvation. It is, for many, the sacred blueprint for the soul.

But what if, alongside this spiritual guidance, the Bible also contained a sophisticated and profoundly practical blueprint for our financial lives? What if its ancient stories, parables, and proverbs held a key not just to eternal wealth, but to building tangible, generational wealth right here on Earth?

This is not a sermon. This is a strategic financial analysis. When we peel back the layers of theological interpretation and examine the text through the lens of an economist or an investor, a startlingly clear financial playbook emerges—one that is more relevant in the 21st century than ever before. It’s a playbook that champions calculated risk, warns against the very consumer debt that defines modern life, and provides a system for automatic wealth creation.

Here are three powerful financial lessons hidden in plain sight within the world's most-read book.

1. The Parable of the Talents: A Divine Mandate to Invest

One of Jesus's most famous stories, the Parable of the Talents (Matthew 25:14-30), is often taught as a lesson about using our God-given gifts. But the literal text is a stark and powerful lesson about capital management.

In the story, a master entrusts three servants with his capital (a "talent" was a significant weight of silver or gold). Two servants immediately put the money to work, investing it and ultimately doubling it. They are praised and rewarded. The third servant, however, gives us the crucial lesson. He tells his master, "I was afraid," so he dug a hole and hid the money for "safekeeping."

The master's reaction is not one of relief that the money is safe. It is one of fury. He calls the servant "wicked and lazy," takes his capital away, and gives it to the one who took the most risk and generated the highest return.

The financial bombshell here is impossible to ignore: the greatest financial sin in this story is not losing money, but letting it sit idle. The servant was condemned not for a bad investment, but for making no investment at all.

In today's world, "hiding your money in a hole" is the perfect metaphor for letting your cash sit in a low-interest savings account. You feel safe. You think you're being responsible. But in an inflationary environment, your "safe" money is constantly losing purchasing power. The parable issues a clear mandate: capital is meant to be deployed. It is meant to be put to work, to be risked, and to grow. "Playing it safe" is portrayed as the ultimate financial failure.

2. The Proverbs on Debt: A Warning of Modern-Day Slavery

While modern society normalizes debt, even encourages it as a tool, the Bible’s Book of Proverbs offers a chillingly different perspective. Proverbs 22:7 gives us one of the most direct financial statements in the entire text: "The rich rule over the poor, and the borrower is slave to the lender."

Let that language sink in. It does not say the borrower is a "client," a "customer," or a "partner." It uses the word "slave."

This is ancient wisdom's take on the true nature of consumer debt. When you carry a balance on a credit card or take out a high-interest personal loan, you are willingly shackling your future self. A portion of your future labor—your time, your intellect, your energy—no longer belongs to you. It is owned by your lender. You go to work every day to build their balance sheet before you can even begin to build your own.

This perspective reframes debt from a simple financial transaction to an issue of personal sovereignty. To be in debt is to have a master. The wisdom here is a call for financial emancipation. The goal of becoming debt-free is not just about having a zero balance; it's about reclaiming ownership of your own life and your own future, freeing up your most valuable asset—your income—to work for you, not for a bank.

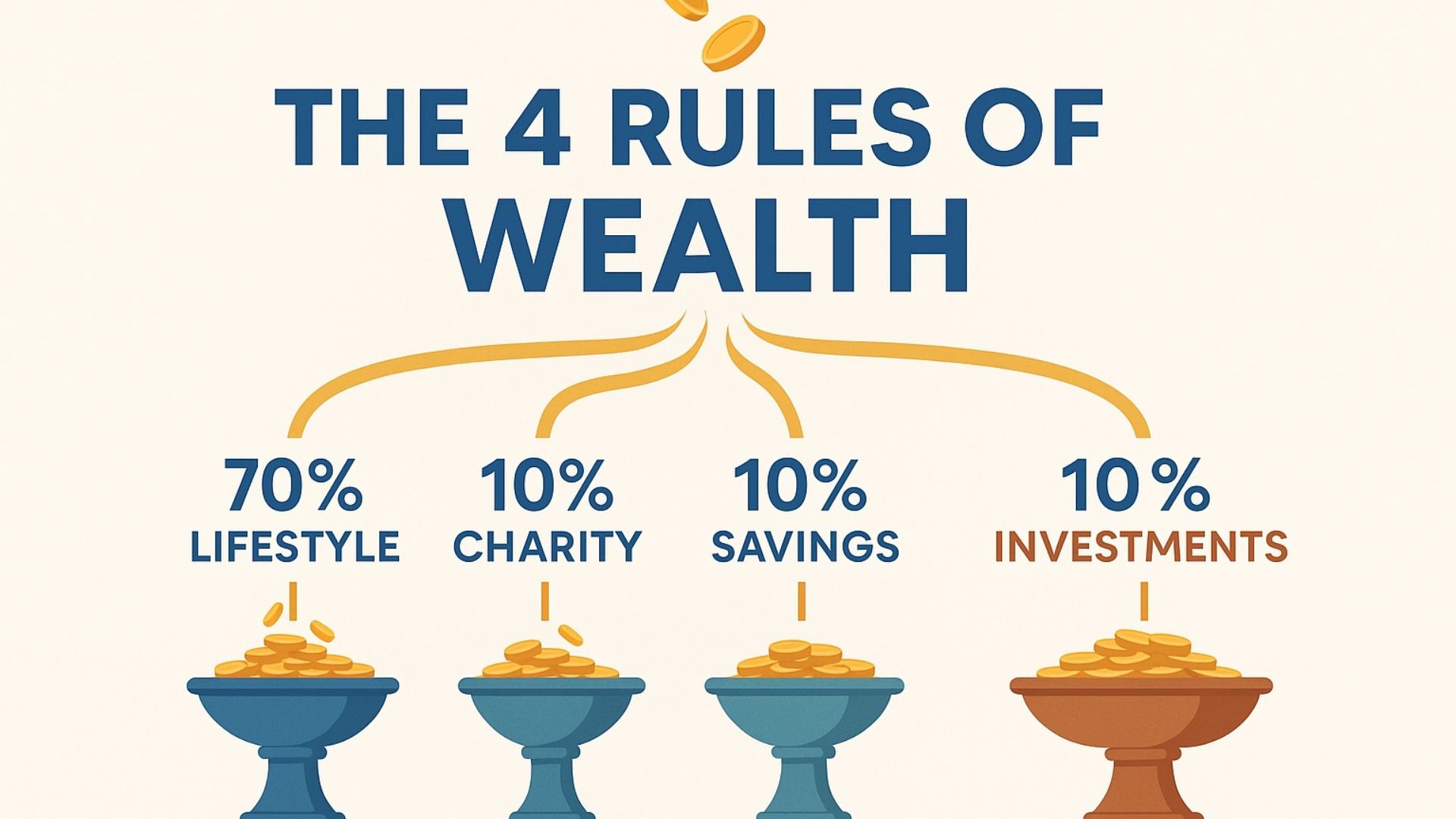

3. The Tithing Principle: A System for Automatic Wealth-Building

The concept of the tithe, or giving the first 10% of your income, is typically viewed as a spiritual act of gratitude and obedience. Whether one follows this practice or not, the financial discipline it teaches is a masterclass in behavioral finance.

The principle is to give the "first fruits," not the leftovers. Before the bills are paid, before the groceries are bought, before any discretionary spending, that first 10% is allocated. The power of this system is that it makes the act of setting money aside automatic, systematic, and non-negotiable. It removes the need for willpower, which is often in short supply after a long week of work.

Now, apply this same discipline to your own financial life. Whether you give that first 10% to a religious institution, a charity, or—and this is the key to personal wealth-building—you pay yourself first by directing it straight into a low-cost index fund or another investment vehicle, the behavioral mechanism is identical.

This ancient practice is the literal blueprint for the modern "Pay Yourself First" strategy, the cornerstone of nearly all credible financial advice. It builds the foundational habit that separates consistent wealth-builders from those who are always "planning" to invest with whatever is left over at the end of the month—which is usually nothing. The Bible understood thousands of years ago what behavioral economists have proven today: a good system will always beat good intentions.

Conclusion: An Ancient Blueprint for a Modern World

A divine mandate to invest your capital. A stark warning that debt is a form of bondage. A disciplined system for automatic wealth creation.

When viewed through this lens, the Bible is undeniably one of the most profound financial texts ever written. It’s not about complex algorithms or market timing, but about the timeless principles that govern our relationship with money, risk, and our own behavior.

It teaches us that building wealth is less about finding the next "hot stock" and more about cultivating discipline, taking calculated risks, and designing systems that make wise financial decisions the default. The assets may have changed from gold and livestock to stocks and Bitcoin, but the fundamental rules of the game have remained remarkably the same. Perhaps the best investment you can make is in understanding this ancient, time-tested wisdom.

What do you think? Does this financial interpretation resonate with you, or do you see it differently? I'd love to hear your thoughts in the comments.